Introduction

In the realm of financial management within an organization, one crucial document stands out: the salary sheet. This document meticulously records the distribution of salaries among employees, encapsulating various allowances, deductions, and net payable amounts. Leveraging the power of Excel, crafting a salary sheet becomes not just convenient but also highly efficient. In this guide, we’ll delve into the intricacies of constructing a salary sheet in Excel with formulas, ensuring accuracy and ease of use.

Understanding the Essence of a Salary Sheet

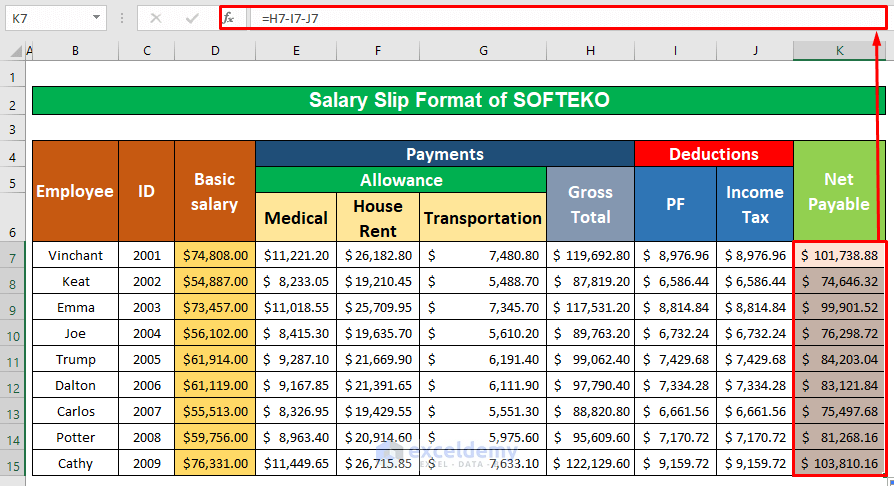

A salary sheet serves as a cornerstone in the payroll system of any company. It’s a comprehensive report that encapsulates vital information regarding employee compensation. Within its structure lie details of basic wages, additional allowances, deductions, and the resulting net payable salary. These components together paint a clear picture of the financial remuneration each employee receives.

Also Read: Exploring The Backrooms: Unveiling Hidden Realms With Google Earth

Deconstructing the Components of a Salary Sheet

Before delving into the nitty-gritty of Excel formulas, let’s dissect the fundamental components that constitute a salary sheet:

-

Employee Database & Salary Structure

This segment houses crucial information such as employee names, their respective basic salaries, and the company’s salary structure. It delineates various allowances provided by the company alongside deductions, offering a holistic view of the financial arrangement.

-

Gross Salary Calculation

The gross salary calculation involves summing up the basic salary with all applicable allowances. These allowances can vary from housing rent allowances to transport allowances, tailored to suit the company’s policies and employee needs.

-

Calculation of Deductions

Deductions play a pivotal role in shaping the final net payable salary. This section computes deductions like taxes, provident funds, and insurance premiums, based on predefined percentages or criteria.

-

Net Payable Salary

The culmination of all calculations leads to the determination of the net payable salary. This figure represents the actual amount an employee receives after accounting for all allowances and deductions.

Step-by-Step Guide to Creating a Salary Sheet in Excel

Now, let’s embark on a journey to construct a salary sheet in Excel, employing formulas to streamline the process:

Step 1: Establish Employee Database & Salary Structure

Begin by creating a new worksheet and structuring it to accommodate employee data and salary information. Designate columns for employee names, basic salaries, allowances, and deductions. This organized setup lays the foundation for seamless calculation and analysis.

Step 2: Compute Gross Salary

Harnessing Excel’s powerful functions, compute the gross salary by summing up the basic salary with all applicable allowances. Utilize formulas like VLOOKUP to retrieve data from the employee database and streamline the calculation process.

Step 3: Calculate Deductions

Next, delve into the realm of deductions. Employ Excel formulas to compute deductions such as taxes and provident funds based on predefined criteria. Leverage functions like SUM to aggregate deduction amounts efficiently.

Step 4: Determine Net Payable Salary

With deductions accounted for, it’s time to ascertain the net payable salary. Subtract the total deductions from the gross salary using Excel formulas, culminating in the final remuneration figure for each employee.

Excel’s Role in Salary Sheet Formulation

Excel serves as an invaluable ally in the creation of salary sheets, offering a plethora of functions and tools to streamline the process. From basic arithmetic operations to advanced lookup functions, Excel empowers users to handle complex calculations with ease and precision.

Also Read: Illuminating Elegance: The Timeless Charm of Chandeliers

Conclusion

Constructing a salary sheet in Excel with formulas is a testament to the synergy between technology and finance. By leveraging Excel’s robust capabilities, organizations can streamline payroll processes, ensuring accuracy and efficiency. As we navigate the intricacies of employee compensation, Excel stands as a beacon of reliability, facilitating seamless financial management.