Introduction

In the realm of financial management and lending, understanding the Total Debt Service (TDS) ratio is paramount. This ratio serves as a crucial metric for lenders, especially in the mortgage industry, to assess a borrower’s capacity to take on additional debt responsibly. In this article, we delve into the intricacies of TDS, explore its calculation formula in Excel, and provide practical insights into its application.

What is Total Debt Service (TDS) Ratio?

The Total Debt Service (TDS) ratio stands as a fundamental financial metric utilized by lenders to evaluate a borrower’s ability to manage debt obligations. Unlike the Gross Debt Service (GDS) ratio, which solely considers housing-related expenses, the TDS ratio encompasses both housing and non-housing debts. Lenders calculate TDS by dividing the total debt obligation by gross income, offering a comprehensive view of an individual’s financial commitments.

Understanding TDS Calculation

To comprehend TDS calculation, one must grasp its components. The housing factor includes mortgage payments, real estate taxes, insurance, association dues, and utilities, while the non-housing factor encompasses auto loans, student loans, credit card payments, and other financial obligations. Lenders typically prefer a TDS ratio below 43%, with many aiming for a benchmark closer to 36% for mortgage approval.

Also Read: Google Fonts Flutter: Enhancing Typography In Flutter Applications

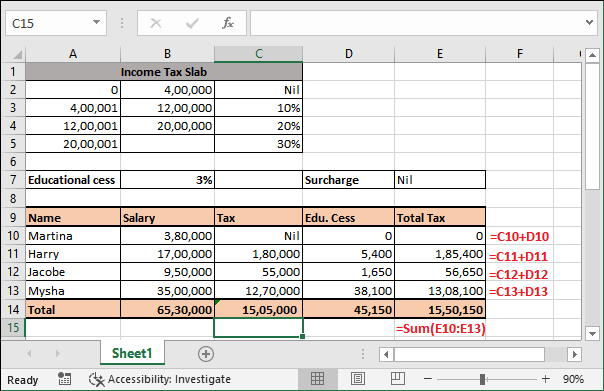

Example of TDS Calculation

Consider an individual with a gross monthly income of $11,000 and monthly debt obligations totaling $4,225, including mortgage, student loan, motorcycle loan, and credit card balance. By dividing the total debt obligation by income and expressing it as a percentage, we arrive at a TDS ratio of 38.4%. This falls within the acceptable range for mortgage approval.

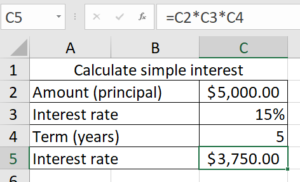

Calculating TDS Ratio in Excel

Excel simplifies TDS ratio computation through its versatile formulas. By using the formula =SUM(debt/income)*100, where debt represents total debt obligations and income denotes gross monthly income, one can effortlessly calculate the TDS ratio. For instance, applying this formula to our example yields a TDS ratio of 38.4%.

Differentiating TDS and GDS Ratios

While both TDS and GDS ratios serve as vital indicators in lending decisions, they differ in scope. The GDS ratio solely considers housing expenses, omitting non-housing payments such as credit card debts and car loans. In contrast, the TDS ratio provides a comprehensive overview of an individual’s overall debt obligations. Both ratios, along with credit scores, play pivotal roles in mortgage underwriting.

Special Considerations in TDS Calculation

Beyond TDS and GDS ratios, lenders take various factors into account when assessing borrowers’ creditworthiness. Small lenders may offer qualified mortgages to borrowers with TDS ratios exceeding 43%, while credit histories and credit scores significantly influence lending decisions. Additionally, larger lenders may consider factors like savings accounts and existing relationships with borrowers when extending credit.

Creating a TDS Interest Calculator in Excel

Excel’s functionality extends beyond basic calculations, enabling users to create intricate financial tools like the TDS interest calculator. By leveraging Excel’s formulas and features, one can develop a comprehensive calculator to determine late fees, withholding, or penalties associated with TDS statements.

Also Read: How To Analyze The Market For Cake Product & Packaging?

Conclusion

In conclusion, mastering the TDS calculation formula in Excel is indispensable for borrowers and lenders alike. By understanding the intricacies of TDS and its significance in lending decisions, individuals can navigate the borrowing process more effectively. Excel’s versatility empowers users to streamline TDS calculations and develop sophisticated financial tools, further enhancing their financial management capabilities. With a thorough understanding of TDS and Excel’s capabilities. Borrowers and lenders can make informed financial decisions and foster financial well-being.