Introduction

In the world of finance and investment, understanding how to calculate simple interest is essential. Whether you’re managing personal finances or dealing with business transactions, being able to compute simple interest accurately can make a significant difference. Fortunately, Excel provides a straightforward method to perform these calculations efficiently. In this comprehensive guide, we’ll delve into the simple interest formula in Excel, breaking down the process step by step.

Understanding Simple Interest

Before we dive into Excel formulas, let’s refresh our understanding of simple interest. Simple interest is a basic calculation of interest that is applied only to the principal amount. Unlike compound interest, which accrues interest on both the principal and accumulated interest, simple interest remains constant throughout the loan or investment period.

Also Read: TDS Calculation Formula In Excel: Understanding And Application

The Formula

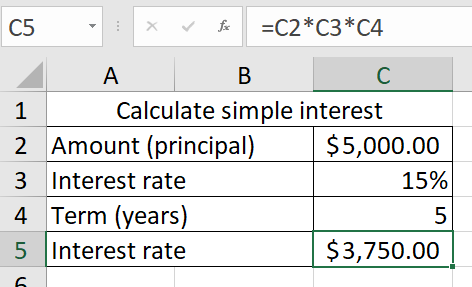

The formula for calculating simple interest in Excel is quite simple:

= Principal Amount * Interest Rate * Term

Here, the principal amount refers to the initial sum of money, the interest rate is the percentage applied to the principal, and the term represents the duration for which the interest is calculated.

Steps to Calculate Simple Interest in Excel

Now, let’s break down the steps to calculate simple interest in Excel:

- Open Excel: Start by opening Microsoft Excel on your computer.

- Enter the Formula: In a cell where you want the result to appear, type the formula mentioned above.

- Input Values: Input the principal amount, interest rate, and term into the formula.

- Apply the Formula: Hit enter, and Excel will calculate the simple interest for you.

Example Calculation

Let’s consider an example to illustrate how to calculate simple interest using Excel:

Suppose you have a principal amount of $1000, an interest rate of 5%, and a term of 10 years. Using the formula mentioned earlier, the calculation in Excel would look like this:

=1000 * 5% * 10

Upon executing the formula, Excel will return the simple interest value.

Understanding the Result

The result obtained from the Excel calculation represents the total amount of interest accrued over the specified term. In the example above, the result would indicate the total interest earned on the $1000 principal over 10 years at a 5% annual interest rate.

Advantages of Using Excel for Simple Interest Calculations

Excel offers several advantages for calculating simple interest:

- Efficiency: Excel allows for quick and accurate calculations, saving time and effort.

- Flexibility: You can easily adjust inputs such as principal amount, interest rate, and term to perform various scenarios analysis.

- Accuracy: Excel’s built-in functions ensure precise calculations, reducing the likelihood of errors.

Conclusion

Mastering the simple interest formula in Excel is a valuable skill for anyone dealing with financial matters. By following the steps outlined in this guide, you can perform simple interest calculations efficiently and accurately. Whether you’re managing personal finances or analyzing investment opportunities, Excel provides a powerful tool for simplifying complex calculations.

So next time you need to calculate simple interest, fire up Excel and let the formula do the work for you!