In today’s financial landscape, Excel remains an indispensable tool for businesses and individuals alike. One of the key financial documents managed through Excel is the balance sheet, a crucial snapshot of a company’s financial health. While there are numerous templates available, not all are created equal. Many lack the automation necessary for real-time data entry and calculation. This article will explore how to create a robust balance sheet format in Excel with formulas, offering both simplicity and sophistication in financial management.

Understanding the Need for Automation

Before delving into the specifics of Excel formulas for a balance sheet, it’s important to grasp why automation is essential. Manual data entry and calculation are not only time-consuming but also prone to errors. A well-structured Excel template with formulas can streamline the process, allowing for accurate and efficient financial reporting. Whether you’re dealing with actual results or forecasting future periods, automation ensures consistency and reliability in your balance sheet preparation.

Excel Accounting Templates: A Game-Changer

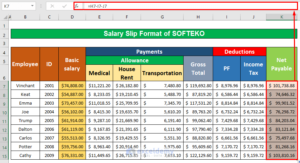

While basic templates may suffice for static data entry, businesses seeking enhanced functionality and automation may need to explore more advanced solutions. Excel accounting templates offer a range of features, from automated balance sheet calculations to comprehensive reporting capabilities. These templates leverage formulas to calculate balance sheet totals based on income and expense transactions entered by the user, minimizing manual intervention and maximising efficiency.

Creating a Balance Sheet from Actual Results

For businesses looking to generate a balance sheet based on actual financial data, Excel templates can provide invaluable support. These templates automatically populate balance sheet items such as fixed assets, intangible assets, and investments, based on transactional information entered by the user. By linking various financial elements, including capital expenditure and loan repayments, these templates offer a holistic view of the company’s financial position.

Also Read: Google Fonts Flutter: Enhancing Typography In Flutter Applications

Forecasting Balance Sheets for Future Periods

In addition to retrospective analysis, Excel templates can facilitate the creation of forecasted balance sheets. By inputting assumptions and projections, users can generate balance sheets for future periods, aiding in strategic planning and decision-making. Key components such as working capital balances, long-term loans, and shareholder equity can be calculated based on user-defined parameters, providing insights into the company’s anticipated financial trajectory.

Step-by-Step Guide to Building a Balance Sheet in Excel

Now, let’s walk through the process of creating a balance sheet format in Excel with formulas:

Step 1: Establishing the Heading

Begin by creating a clear and concise heading for your balance sheet. Include the name of your company, the term “Balance Sheet,” and the date of preparation. Merge cells as necessary for a polished presentation.

Step 2: Inserting Balance Sheet Components

Identify the main components of the balance sheet: Assets, Liabilities, and Shareholder’s Equity. Enter these categories in separate columns, with corresponding amounts to be entered alongside.

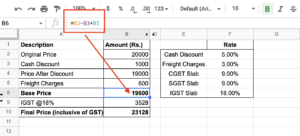

Step 3: Formatting the Amount Column

Before entering data, format the amount column to ensure consistency and clarity. Apply the appropriate number format, such as Accounting with two decimal places, to enhance readability.

Step 4: Inputting Current Assets

Enter current assets, such as Cash and Equivalents, Account Receivable, and Inventory, along with their respective amounts. Utilize Excel formulas, such as SUM, to calculate the total current assets automatically.

Step 5: Adding Fixed Assets

Include fixed assets, such as Plant & Equipment, and account for depreciation as necessary. Employ formulas to calculate the net fixed assets, ensuring accuracy in financial reporting.

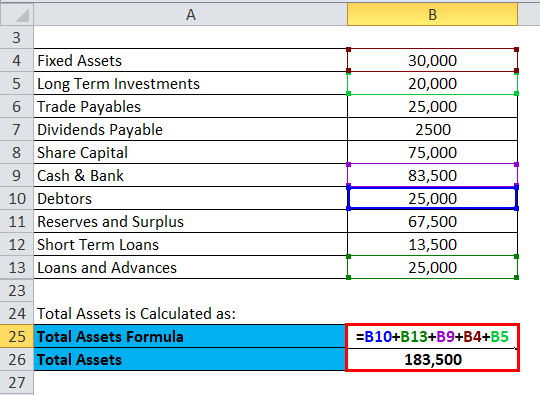

Step 6: Calculating Total Assets

Aggregate the total assets by summing up the values of current assets and net fixed assets using Excel formulas. This provides a comprehensive overview of the company’s asset base.

Step 7: Including Current Liabilities

Enter current liabilities, such as Accounts Payable and Short-Term Notes Payable, and their corresponding amounts. Utilize formulas to calculate the total current liabilities, simplifying the balance sheet preparation process.

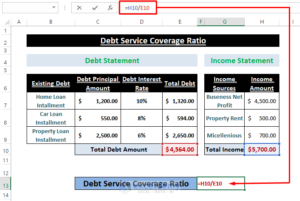

Step 8: Estimating Total Liabilities

Incorporate long-term liabilities, such as Long-Term Debt, into the balance sheet. Employ formulas to calculate the total liabilities, providing insight into the company’s debt obligations.

Step 9: Calculating Total Shareholder’s Equity

Enter shareholder’s equity components, including Common Stock, Treasury Stock, and Retained Earnings. Utilize formulas to calculate the total shareholder’s equity, reflecting the company’s net worth attributable to its owners.

Step 10: Determining Total Liabilities & Shareholder’s Equity

Sum up the total liabilities and shareholder’s equity using Excel formulas to ensure the balance sheet balances. This step validates the accuracy of the financial statements and confirms adherence to the accounting equation.

Conclusion: Harnessing Excel’s Power for Financial Management

In conclusion, Excel serves as a powerful tool for creating balance sheet formats with formulas. By leveraging automation and formulas, businesses can streamline financial reporting processes, enhance accuracy, and gain valuable insights into their financial performance. Whether analyzing past results or forecasting future trends, Excel empowers users to make informed decisions and drive business success.

With a clear understanding of Excel’s capabilities and a structured approach to balance sheet preparation, businesses can unlock the full potential of their financial data. By implementing best practices and utilizing advanced Excel templates, companies can optimize their financial management processes and achieve greater efficiency and effectiveness in today’s dynamic business environment.

In summary, mastering the art of balance sheet formatting in Excel with formulas is not just a skill; it’s a strategic advantage in the pursuit of financial excellence. As businesses continue to navigate challenges and opportunities, Excel remains an invaluable ally, providing the tools and insights needed to thrive in an ever-evolving marketplace.

By embracing innovation and harnessing the power of technology, businesses can chart a course towards financial success and sustainability. Excel balance sheet formats with formulas are not just spreadsheets; they’re blueprints for financial prosperity and strategic growth.