In the realm of financial analysis and real estate investment, one crucial metric stands out as a beacon of insight: the Debt Service Coverage Ratio (DSCR). This ratio, often calculated using Excel, provides invaluable information about a company’s ability to service its debt obligations. Let’s delve deeper into this essential financial concept and learn how to wield it effectively in Excel.

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) serves as a litmus test for a company’s financial health, specifically its ability to cover its debt obligations. Expressed as a ratio, it measures the relationship between a company’s net operating income and its total debt service.

The Formula

The formula for calculating the Debt Service Coverage Ratio (DSCR) is elegantly simple:

DSCR = Annual Net Operating Income / Total Debt Service

In this formula, the net operating income represents the income remaining after deducting all operating expenses from revenue. On the other hand, the total debt service encompasses all debt-related payments, including interest, principal, and other obligations.

Also Read: TDS Calculation Formula In Excel: Understanding And Application

Interpreting the DSCR

A DSCR greater than 1 signifies that a company generates sufficient income to cover its debt obligations comfortably. The higher the ratio, the better, as it indicates a healthier financial position and a lower risk of default.

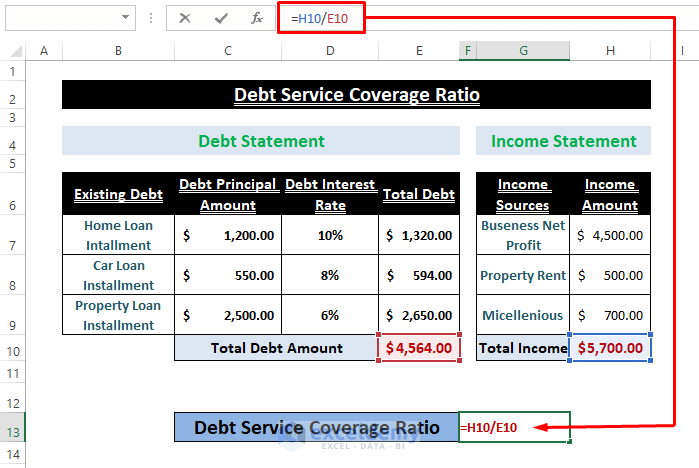

Examples of Calculating DSCR in Excel

Let’s walk through a couple of examples to illustrate how the Debt Service Coverage Ratio can be computed using Excel.

Example 1:

Consider Company A, which is contemplating expansion but lacks sufficient cash reserves. They’re evaluating the option of taking on additional debt. Here are the financial details:

- Annual Net Operating Income: $100,000

- Total Debt Service: $85,000

Using the DSCR formula, we find:

DSCR = $100,000 / $85,000 = 1.176

This DSCR indicates that Company A generates enough operating profit to service its existing debt and can likely secure additional financing for expansion.

Example 2:

Let’s analyze Ford, a well-known automotive company. From their income statement:

- Net Operating Income for 2018: $556.652k

- Debt Payment: $115.447k

With these figures, the DSCR can be calculated as:

DSCR = $556.652k / $115.447k = 4.82

Ford’s high DSCR suggests a robust ability to meet its debt obligations, reassuring investors and lenders alike.

Using Excel to Calculate DSCR

Excel simplifies the process of calculating DSCR, offering efficiency and accuracy. By inputting the relevant financial data into Excel sheets and applying the DSCR formula, analysts can swiftly derive insights into a company’s financial viability.

Steps to Calculate DSCR in Excel

- Prepare the Data: Gather the necessary financial information, including net operating income and total debt service.

- Input Data into Excel: Enter the financial figures into designated cells within an Excel spreadsheet.

- Apply the DSCR Formula: Utilize Excel’s formula bar to input the DSCR formula, dividing the net operating income by the total debt service.

- Review and Interpret Results: Examine the calculated DSCR to gauge the company’s ability to service its debt obligations effectively.

Analyzing the DSCR

A DSCR above 1 indicates a healthy financial position, while a ratio below 1 suggests potential challenges in meeting debt obligations. It’s essential to benchmark a company’s DSCR against industry standards and peers to gain deeper insights into its financial standing.

Conclusion

In conclusion, the Debt Service Coverage Ratio formula in Excel serves as a powerful tool for evaluating a company’s financial strength and capacity to manage its debt. By understanding and applying this fundamental concept, investors and analysts can make informed decisions and mitigate financial risks effectively. Excel’s versatility and efficiency further enhance the utility of the DSCR formula, enabling swift and accurate analysis in the dynamic world of finance.