Introduction

In the realm of financial management and accounting, understanding the Goods and Services Tax (GST) and its calculation is indispensable. For businesses and individuals alike, Excel serves as a powerful tool for crunching numbers and ensuring accurate tax calculations. In this guide, we’ll delve into the intricacies of GST calculation formula in Excel, providing step-by-step instructions and insights to empower you in managing your tax obligations efficiently.

Understanding the GST Formula

GST, a consumption-based tax, is levied on the supply of goods and services. The GST formula facilitates the calculation of the tax amount based on the price of a product or service. In Excel, this calculation can be performed effortlessly, ensuring compliance with tax regulations and accurate financial reporting.

Also Read: Mastering Balance Sheet Format In Excel With Formulas

Step-by-Step Guide to GST Calculation in Excel

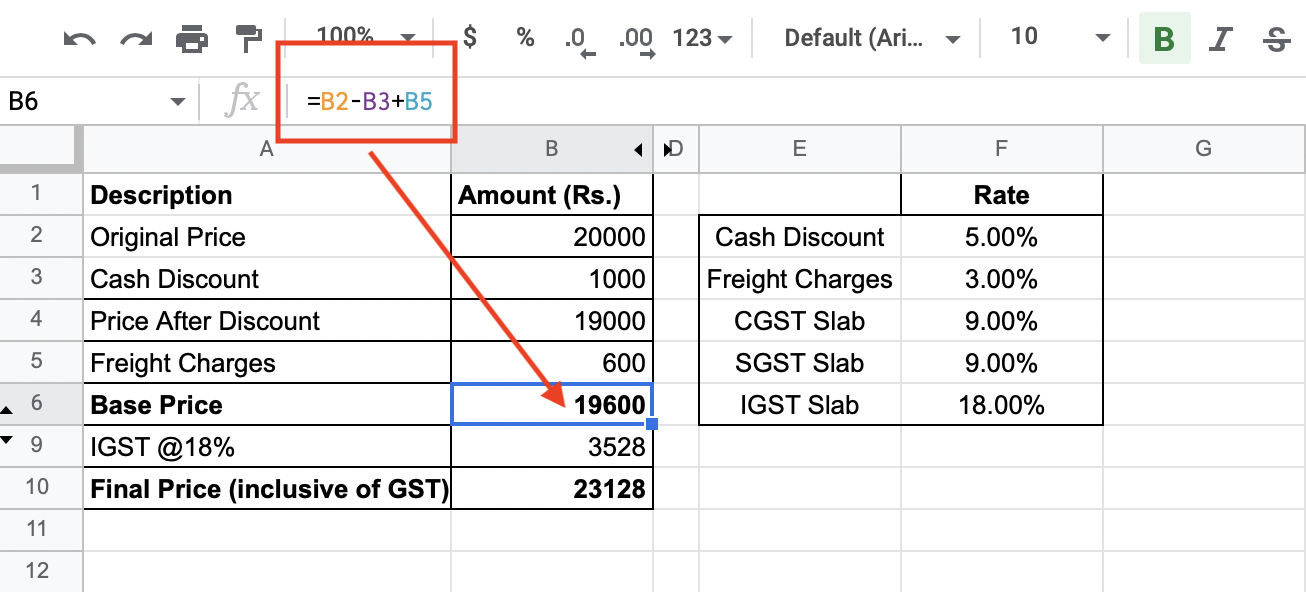

1. Setting Up Your Excel Spreadsheet

Before diving into the calculation process, it’s essential to organize your Excel spreadsheet effectively. Allocate specific cells for inputting the price of goods/services, GST rate, and total price including GST. This structured approach streamlines the calculation process and minimizes errors.

2. Calculating GST Amount

In Excel, calculating the GST amount is straightforward. Begin by selecting the cell where you want the GST amount to be displayed. Then, input the formula “=B1*B2”, where “B1” represents the cell containing the price of goods/services excluding GST, and “B2” represents the cell containing the GST rate. Press Enter, and Excel will automatically compute the GST amount based on the provided inputs.

3. Determining Total Price Including GST

Once the GST amount is calculated, proceed to determine the total price including GST. Select the cell where you want the total price to be display and input the formula “=B1+B3”, where “B1” represents the price of goods/services excluding GST, and “B3” represents the calculated GST amount. Press Enter to obtain the total price, inclusive of GST.

4. Customizing GST Calculation

Excel offers flexibility in customizing GST calculations to suit specific requirements. Users can adjust formulas to accommodate varying GST rates, discounts, and other factors influencing the final price. Experimenting with different formulas and scenarios enhances proficiency in Excel and fosters a deeper understanding of GST calculation principles.

Benefits of Using Excel for GST Calculation

Excel’s versatility and user-friendly interface make it an ideal platform for performing GST calculations. Some key benefits include:

- Accuracy: Excel’s built-in mathematical functions ensure precise GST calculations, minimizing errors and discrepancies.

- Efficiency: With Excel’s automated features, repetitive tasks associated with GST calculation can be performed swiftly, saving time and effort.

- Flexibility: Excel allows users to customize formulas, pivot tables, and charts, enabling tailored analysis and reporting based on specific business needs.

- Accessibility: Excel is widely accessible and familiar to users across industries, making it a practical choice for managing GST calculations in diverse organizational settings.

Real-World Applications of GST Calculation in Excel

Beyond theoretical understanding, mastering GST calculation in Excel has tangible applications in real-world scenarios. Businesses can utilize Excel to track GST liabilities, prepare accurate tax returns, and analyze financial data for strategic decision-making. By harnessing the power of Excel, individuals and organizations can navigate the complexities of GST compliance with confidence and proficiency.

Conclusion

In conclusion, mastering the GST calculation formula in Excel is a valuable skill for individuals and businesses alike. By following the step-by-step guide outlined in this article, you can effectively compute GST amounts, ensure tax compliance, and optimize financial management processes. Excel’s versatility combined with a thorough understanding of GST principles empowers users to navigate the intricate landscape of taxation with ease and precision. Embrace Excel as your ally in GST calculation, and unlock new levels of efficiency and accuracy in your financial endeavors.